The news around climbing truckload rates is not all gloom and doom. A combination of factors across the broader domestic transportation marketplace will spur a drop in demand and relief on rates.

You can control some of those costs today by balancing procurement between spot market opportunities with short- and long-term contracts. At the same time, your strategy through the second quarter can position you for cost and service gains heading into 2022.

Let’s examine factors affecting truckload rates during the months ahead, and I will share some of the ways we help Transportation Insight clients respond in the current environment.

Truckload Demand Varies, Rates Remain High

Coming into 2021, truckload rates were at a peak. High, steady pricing will likely continue without many dips as we head through the growing season. Tighter capacity for produce and beverages coincides with increased summer highway travel, and we will see upward rate pressure until the July 4 holiday period when demand traditionally tapers off.

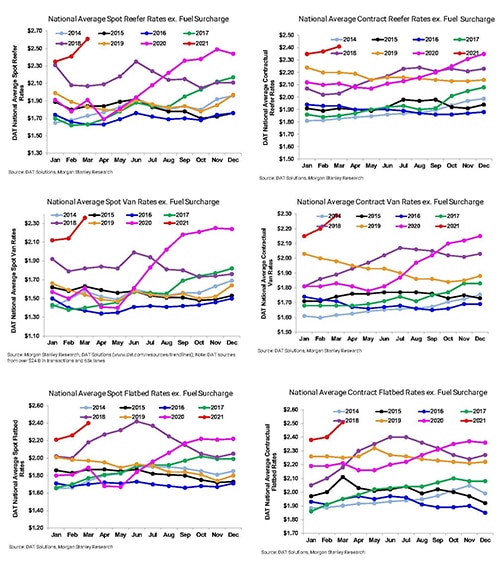

National average spot and contract rates through April 27, 2021. Year-to-year comparisons (2021 in red) for reefer, dry van and flatbed. Source: Morgan Stanley Research, DAT Solutions.

That demand has not really decreased since the nation started coming out of pandemic lockdowns last summer. Retailers and manufacturers rushed to restock depleted inventories, and the holiday peak season added strain on capacity not just in the truckload marketplace, but also less-than-load and parcel.

Service issues and disruptions in LTL, intermodal and parcel are pushing more freight into the over-the-road world. Shippers facing accessorials (i.e. excessive length charges) or delivery delays with LTL can find benefit in multi-stop truckload shipments. We have customers where modal conversion to rail is usually worth considering, but not in this environment. That freight, too, is also competing for truckload capacity.

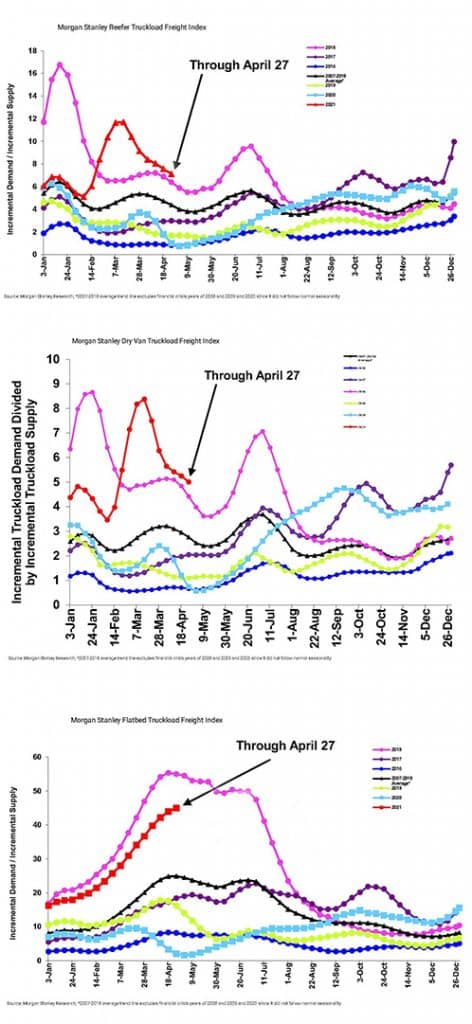

Until some of the capacity challenges in other modes work out, capacity pressure will continue, likely until July, when I expect rates will recede. Even if demand declines before that, as it has recently for refrigerated and dry van transportation, do not expect costs to drop. Flatbed demand is still going strong, and while it is down for those other equipment types, prices have not yet followed.

Truckload Freight Index measuring demand for services compared to supply through April 27, 2021. Year-to-year comparisons (2021 in red) for reefer, dry van and flatbed. Source: Morgan Stanley Research.

There are a few factors keeping these truckload rates elevated.

Truckload Carrier Costs, Fuel Prices Drive Up Rate-Per-Mile

Truckload rates have not dropped for dry van and refrigerated due, in part, to the capital expenses some carriers are enduring with new equipment purchases. Insurance premiums continue to go up for operators. Driver retention and training add new costs, and we have seen some dramatic increases in driver wages announced lately.

This all creates upward rate pressure from carriers who are trying to stay profitable.

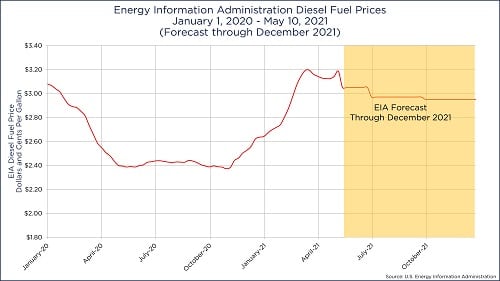

Now fuel prices are returning to the conversation after a relatively quiet past couple of years. The average price of diesel fuel climbed 34.6 percent between November 2020 and May 10, according to the Energy Information Administration (EIA). We expect prices to plateau, but look for them to increase as the summer months bring more travel for produce growers, beverage producers and North America’s vacationing public. As of May 10, EIA predicts the 2021 average will be about $2.97 per gallon - a 3-cent increase compared to the April forecast. To put that in perspective, in 2020, the average was $2.55 per gallon.

National average diesel fuel prices through May 10, 2021 and forecast through December 2021. Average retail price per gallon was $3.18, up 4 cents from May 3, but still below the March 22 peak of $3.19. Source: U.S. Energy Information Administration.

National average diesel fuel prices through May 10, 2021 and forecast through December 2021. Average retail price per gallon was $3.18, up 4 cents from May 3, but still below the March 22 peak of $3.19. Source: U.S. Energy Information Administration.

This uptick will have a cost impact, even if it may not be readily apparent. If you are in the contract-pricing world, you will generally see the added fuel charges broken out, so you can report off of it. When you are in the spot market, however, all of that is lumped into one charge. That makes it hard to specify the fuel impact on spot rates, which are climbing to a higher premium than last year.

Relief is in Sight for Shipping Costs, Truckload Rates

As I mentioned, I think the broader transportation marketplace should experience some rate relief after the July 4 holiday. My colleagues in LTL and International transportation both expect conditions to steady somewhat in their modes by then. That will alleviate some of the added capacity pressure on full truckload transportation.

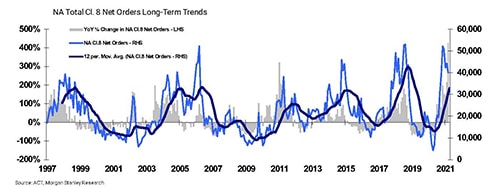

New equipment and drivers coming online will help, too. We saw Class 8 truck sales increase month-over-month and building throughout the second half of last year.

Total Class 8 Net Orders, reflecting a significant upturn in late 2020 into 2021. Source: ACT, Morgan Stanley Research.Those vehicles should start hitting the road soon – even with many of those orders being delayed up to 60 Days. Driver training programs restarted after pandemic closures will fill more seats. The current rate environment will likely draw out-of-work drivers back into the job market, as well.

All these things coinciding with a demand drop should create a dip in truckload rates. That opens the door for you to explore strategic procurement opportunities, utilizing the benefits of the spot and contract markets.

Balancing Truckload Rates with Spot and Contract Procurement

In the current rate environment, especially with spot rates at a premium, we look strategically at truckload options for our clients.

For instance, we identify freight volume that can be moved from the less predictable spot market into a short-term contract. Even while short-term rates are elevated, they are still below spot rates. There is a chance to capture savings, and, more importantly, lock in rate consistency and capacity for our customers.

It also sets the stage for you to take advantage of the downward trend coming later in the year.

I am a big believer in maintaining your carrier partnerships – and not just when the conditions are in your favor as a shipper. Now is the time to work with your carriers to try to lock in pricing and capacity. Be flexible in accepting lane-by-lane increases in the current tight market. Short-term contracts can help – and they help solidify your relationship. When demand and rates decline, you are positioned to leverage your future volume for savings.

There is a natural temptation to flip everything back into spot procurement and catch rapid savings when the truckload rate swing occurs. Instead, consider putting a lower volume in the spot market, but also prepare for a larger network RFQ to capture a long-term contract at a price point lower than the short-term contracts yielded.

We help our customers achieve consistency with their carrier partners by locking in pricing where possible now. Then, as rate pressure alleviates, we support strategic conversations with your carriers to help you get market-competitive rates while maintaining the capacity commitments that support the service levels you need.

Control Costs in any Rate Environment

Our transportation management team constantly monitors market conditions to keep our customers informed about trends that affect their cost and service.

This proactive approach empowers shippers to quickly deploy strategic adjustments and control budget impacts of a volatile rate environment. For more transportation industry analysis, download our Q2 Industry Forecast.

Read it for actionable guidance that will support timely adjustments to your transportation management and keep your freight moving.