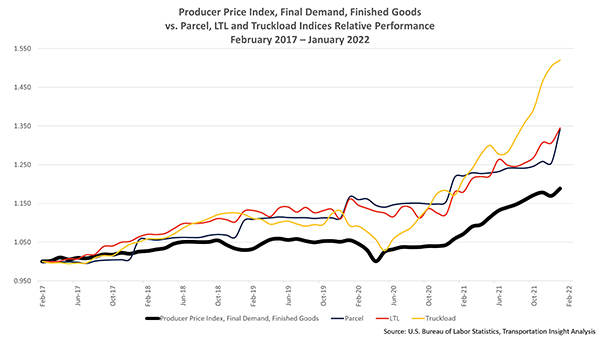

A leading economic indicator, the producer price index (PPI), tells the story of the current situation and what we can likely expect for the remainder of the year.

According to the U.S. Bureau of Labor Statistics, the PPI measures the average change over time in the selling prices received by domestic producers for their output. In other words, it measures the price change from the seller's perspective.

For January, the most recent available data, the PPI for total final demand increased 1.0% after rising 0.4% in December 2021 and 0.9% in November, seasonally adjusted. On an unadjusted basis, total final demand prices increased 9.7% for the 12 months ended January 2022.

A look deeper into the PPI data finds, to no one’s surprise, that the final demand for transportation and warehousing services increased 15.7% since January 2021. Of the transportation modes, trucking increased 18.3% year-over-year, followed by air at 10.8%, rail at 9.0%, and courier, messenger & US postal services close behind at 8.9%.

Within the trucking segment, long-distance less-than-truckload (LTL) noted the biggest month-to-month increase in the trucking segment, up 3.0% from December to January, while TL noted a 1.1% increase. However, year-over-year, demand prices for TL increased 27.9% compared to a year-over-year increase of 14.0% for LTL.

Why Does This Matter?

The trucking market moves most of the U.S. domestic freight. According to the American Trucking Associations, trucks moved 72.5% of total domestic tonnage shipped in 2020, the latest figure available.

But trucking faced many issues in 2021, spilling over into 2022, including not enough drivers and high demand for trucking services from ports to warehouses and stores.

The American Trucking Associations estimates that the industry needs 80,000 more drivers. That figure is expected to worsen in the years ahead with a lack of new drivers to offset retirements and growing demand.

However, there is a debate over whether there is a shortage of drivers or if retention is the problem. According to a recent Quartz article, the American Association of Motor Vehicle Administrators notes that about 2 million Americans work as licensed truck drivers, and states issue more than 450,000 new commercial driver's licenses every year.

Regardless, trucking firms are raising pay, increasing benefits to attract drivers, and making it easier for potential candidates to receive the training needed to drive trucks – all of which contribute to the PPI increase in transportation.

Want More Insight?

Looking for more insight into transportation trends for the remainder of Q1 2022 and beyond? Download the Q1 2022 Transportation Forecast now.